More about

Designed for everyday investors, EasyFunds investment funds are unit trusts that are simple to understand and monitor.

They predominantly use an index tracking investment management style. An index tracking investment management style aims to achieve returns that closely track those of a market index (or a combination of market indices). However, an index tracking investment management style is not expected to exactly match the returns of an index, because an index cannot be tracked with absolute precision.

The EasyFunds Trusts have also been designed to be tax efficient for investors to handle. They are Portfolio Investment Entities (PIEs), meaning any taxable income earned by the Trusts will be taxed at the applicable Prescribed Investor Rate (PIR) of 0%, 10.5%, 17.5% or 28%.

EasyFunds Trusts invest in:

- Diversified income assets - cash, United States and world fixed interest.

- Diversified growth assets - global property shares, Australasian and world shares.

Each Trust has a different mix of asset types. This means we can help you choose the Trust that suits your investment needs best.

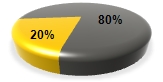

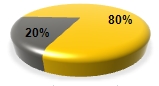

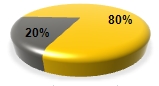

EasyFund Defensive Trust

Conservative capital growth over the short to medium term. 80% income assets, 20% growth.

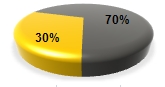

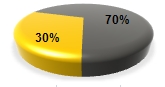

EasyFund Conservative Trust

Conservative capital growth over the short to medium term. 70% income assets, 30% growth.

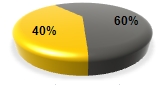

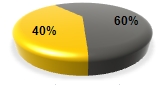

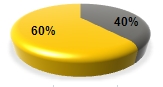

EasyFund Moderate Trust

Moderate capital growth over the medium to long term. 60% income assets, 40% growth.

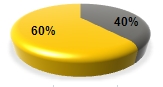

EasyFund Balanced Trust

Long-term capital growth. 40% income assets, 60% growth.

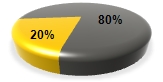

EasyFund Growth Trust

Higher long-term capital growth. 20% income assets, 80% growth.

For more information on all Trusts, please contact one of our Wealth Managers. They'll listen carefully to understand your goals and offer advice to help you make the right decision.

Fees

The fees currently charged for the EasyFunds Trusts are the management fee, trustee fee and service fee outlined below. No fees are charged for advice and there are no switching or exit fees. However, ABC Bank Group Investments and the Trustee are entitled to be reimbursed out of the Trusts for costs and expenses associated with their respective duties.

Management fee

This fee is calculated as a percentage of the gross asset value of the relevant Trust. It's a fee that is paid to the manager for investment management and other services in relation to the Trust. The management fee is set by the manager from time to time, but will be no greater than 3% per annum (plus any GST) of the gross asset value of each Trust.

The current management fee (exclusive of GST) for each of the Trusts is set out below:

| Trust | Per annum |

| EasyFund Defensive | 0.90 % |

| EasyFund Conservative | 1.00 % |

| EasyFund Moderate | 1.05 % |

| EasyFund Balanced | 1.10 % |

| EasyFund Growth | 1.15 % |

Trustee fee

This fee is based on the total gross asset value of all of the Trusts. It's an annual fee paid to the trustee for the services it provides in respect of the Trusts. The trustee fee is scaled based on the overall funds held in easyfunds. The maximum fee that can currently be charged is 0.06% per annum. The trustee is also able to charge special fees to reflect additional services provided.

Service fee

This fee is charged as a percentage of the application moneys received when you invest in a Trust. The service fee is a one-off charge deducted from all moneys invested (including regular contributions), and is paid to the manager. The service fee is set from time to time by the manager and will be no greater than 3% of the application moneys received (plus any GST).

| | |

| All EasyFunds Trusts | 0.45 % |